Asset class cycles - Real Estate

- Plan Alfa Wealth

- Jun 24, 2021

- 4 min read

If we could build houses in the sky, we would but we can’t so we’ll stick to the ground. For now.

This is an expansion on our retirement planning and “Understanding Asset Cycles” article. In this one, we are diving into the world of Real Estate! Real estate is not only about investing in land. It is also investments into retail and commercial properties that can then become steady sources of income.

Here is a point to remember though, the house you live in or that gorgeous beach house that you visit every summer is not an investment. These are consumption items because you live in them and use them. A real estate investment is purely an investment, separate from your permanent address.

A few ways to invest in Real Estate are buying Land, which could be agricultural or construction. Investing in rental properties that are retail like houses you and I live in or commercial like the offices you and I work in. You can even become a “flipper”! Someone who buys properties they see potential in, gives it a quick makeover and selling the now beautiful property. These are just some of the ways you can invest in the market.

Investing in Real Estate should definitely be something you consider when you are allocating for your portfolio. For many many reasons, Real Estate makes a very attractive avenue. It’s a tangible asset, you can actually go feel the walls of your investment, you can have steady cash flow from properties, there are multiple tax benefits to take advantage of and it acts as a great asset to diversify your portfolio.

Now, this begs the question if Real Estate is right for your portfolio. Here’s an example of different asset allocations and look at their risk and return:-

From the above table, we can note that just investing in the nifty (equity) or gold (commodity) does generate a higher return. However, if we look at the range and the risk (here, standard deviation), they are quite volatile. If we shift the allocation to an equal-weighted portfolio of nifty, gold, and Real Estate, the risk goes down significantly. But like with all asset classes, even over allocation of Real Estate will bit you back in the form of:

Non-rental income periods, which will create major volatility in the Rental income

Difficulty in Maintenance and rental collection of properties.

Real Estate is highly illiquid, if you want to sell on an urgent basis you might have to give a discount of 20-30%.

These are a few of the problems that can be seen. But there is one more devil which is the form of the Real Estate Cycle, you should be aware of this before investing in real estate.

The introduction of Real Estate in one’s portfolio actually helps to diversify the portfolio very well without giving up on too many returns. Another plus is that real estate is a growth asset and is cyclical in nature, so there is ample opportunity to make very good returns in this market. To better understand it, we will need to understand the phases of the Real Estate market.

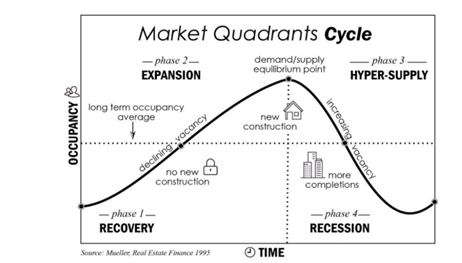

Let’s briefly outline the four main phases in the real estate cycle -

Recovery: Due to the fact that Real estate is cyclical, the recovery phase sometimes looks very similar to the recessionary phase. Rents and property values are low, there are low construction rates but these gradually rise. This is a period of speculation and investment as prices are low and many believe the worst to be behind them

Expansion: In this phase, the economy is plowing full speed ahead. Business is booming and cities are bustling. Occupancy is high, ergo rent is high and vacancy is low. This is the main time period where real estate investors get in because people need housing/offices.

Hyper Supply: The supply will finally catch up and exceed high demand as previously started construction projects continue to wrap up. Vacancies will actually start to increase and rent prices are slow to grow.

Recession: There are very few things in life that are inevitable, and a recession is one of them. When a recession hits and the economy’s in a bad shape, construction stalls, property prices hit rock bottom, and rent grows below the rate of inflation.

One thing that sets real estate apart from other asset classes like commodities or equity is that these cycles are quite long. A real estate cycle can last anywhere between 12 to 30 years. It is in fact a patient person’s game. The longer the cycle is, the less volatile it is. Real estate is also a big-ticket game. It is not easy for all investors to enter this market. However, if you are looking into investing in real estate here are a few pointers.

Another reason to invest in Real Estate is that it is a fantastic protector against inflation.

Inflation is a silent killer of your purchasing power. Inflation means a sustained increase in the price of goods and services. This means what you buy for 100 rupees today, you’ll need to pay 120 rupees for in an inflationary environment. So protecting your capital from inflation is crucial. Real Estate is a great asset that’s inflation protected.

Real estate is a popular choice to protect against inflation because rising prices increase the resale value of the property, RE properties also generate rental income, which can be hiked with inflation.

So even though prices are rising generally in the economy, the price of your property goes up too and helps them keep pace with the general rise in prices across the economy. The beauty of it is that it’s not stagnant, like fixed income instruments. So if there is a general price rise in the economy, your property value will rise too. This coupled with the fact that rising prices increase rents means your investment remains protected through an inflationary environment.

All in all, Real Estate is an incredibly versatile asset class. From Residential and Commercial properties to Arable land, it’s got it all! With solid returns when invested in for the long term. As we recover from the pandemic and life returns to normal as we know it, Real Estate is definitely an asset class to keep your eyes on!

Our Other Articles on:

Comments